I do know you might have heard about danger administration so many occasions earlier than.

So at the moment, we are going to speak about an idea in danger administration that I don’t see talked about a lot on the web.

Have you learnt your private P&L distribution curve?

Your P&L (revenue and loss) distribution curve have to be of a sure form to be worthwhile.

In case you are not worthwhile, you might want to reshape this P&L distribution curve.

Contents

This text will focus on two methods to have an effect on this distribution curve.

Firstly, you have to change the way in which you deal with danger.

The second step is to let your winners run.

I do know that each one of you studying this are already managing danger.

I don’t need to inform you that managing danger is important whether or not you might be buying and selling choices, futures, Foreign exchange, or shares.

However are you managing danger sufficient?

The P&L distribution curve will inform you in case you are or not.

What do I imply by the P&L distribution curve?

Think about the next bull put credit score unfold, which acquired a credit score of $170 on entry.

Whereas the underlying ticker isn’t essential, you most likely can see it within the graph close to the $389 value mark that the underlying is at present buying and selling.

With a max danger of $830 and a max potential reward of $170, this commerce has a risk-to-reward of 4.8, which is appropriate and typical of such out-of-the-money credit score spreads.

Think about a dealer who likes to commerce these spreads and takes revenue at round 50% of the credit score acquired, which isn’t unusual.

On this case, his revenue goal is $85.

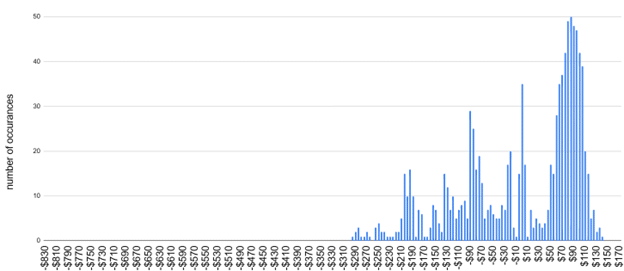

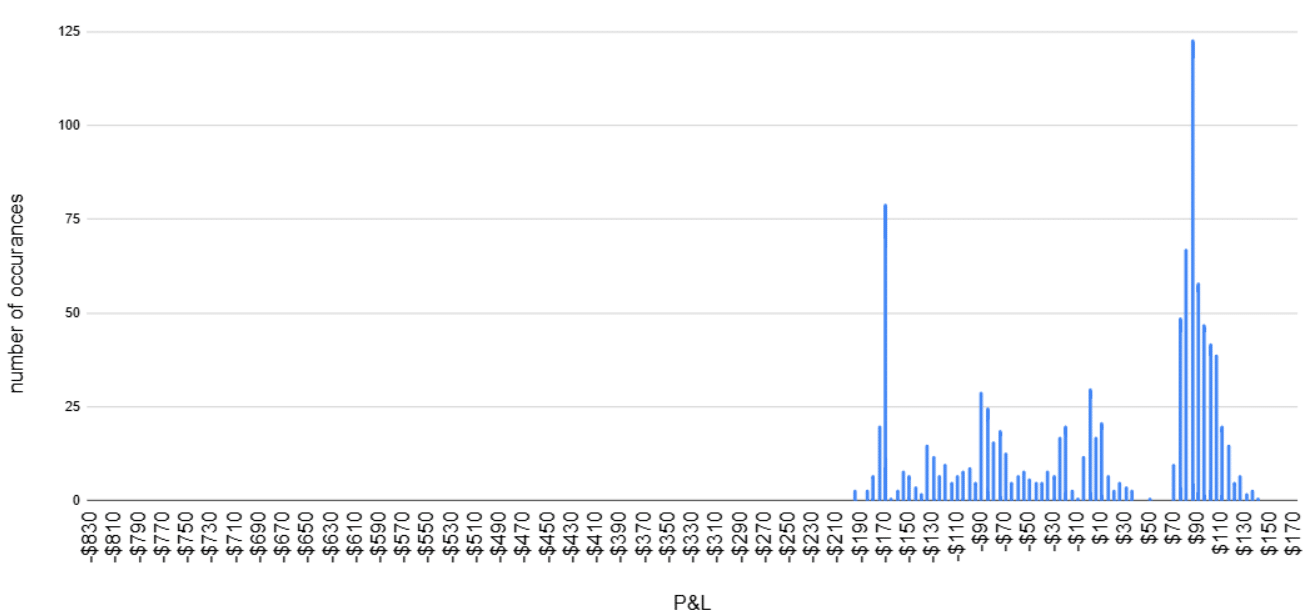

After 1000 trades, he makes use of a spreadsheet to plot the P&L of every commerce in a histogram like this:

The P&L is proven on the underside horizontal x-axis.

The variety of occurrences of that P&L is proven within the vertical y-axis.

That is what I imply by the P&L distribution curve.

It tells you the way your revenue and loss are distributed.

Do you might have a number of wins compared to losses, or vice-versa?

And the way massive are every?

For instance, of the 1000 trades, he had 50 trades that made a revenue of $85.

You see this within the graph as the best histogram bar with the best variety of occurrences.

That is anticipated as a result of he takes income when the unfold makes $85 (half of the credit score acquired).

We see a excessive variety of wins clustered within the $70 to $110 P&L vary.

One other cluster of trades broke even at a P&L of zero.

These might need been shedding trades that got here again to breakeven, and he determined to shut them with out taking a loss, which can be a sound choice buying and selling danger administration technique.

There’ll, after all, be some shedding trades.

He is aware of higher than to take a most loss on a credit score unfold.

So, he exits the trades he doesn’t suppose will return to profitability.

There’s a cluster of losses across the adverse -$85 loss degree.

It is because he is aware of to not let the greenback quantity of his losses be an excessive amount of bigger than his wins, which can be a sound technique for managing danger in choices buying and selling.

Now the query is:

this distribution graph of wins and losses, do you suppose this dealer is worthwhile?

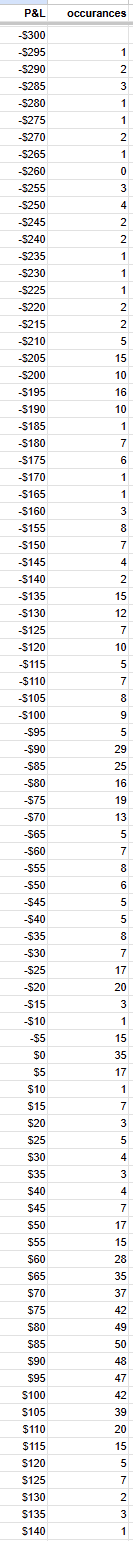

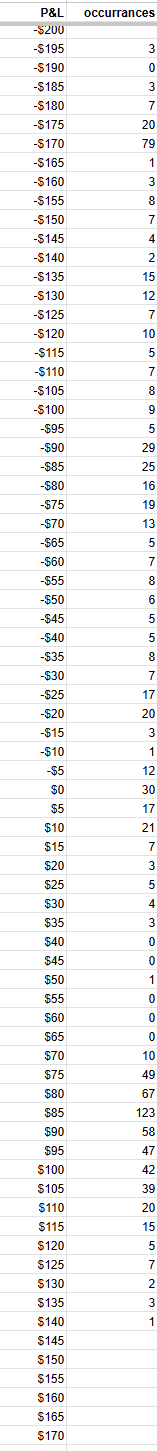

Okay, I’ll provide you with extra information by displaying you the P&L of every of the 1000 trades:

Extra trace:

There are 553 wins and 412 shedding trades.

Thirty-five trades have been at breakeven.

If you happen to accumulate all of the P&Ls over the variety of occurrences, you’ll find that this distribution profile is NOT worthwhile regardless of having extra wins than losses.

The online loss from all the 1000 trades was -$2005.

Whereas the dealer made good makes an attempt at managing danger, the danger management was nonetheless not tight sufficient for his specific take-profit degree.

With out monitoring the wins and losses, he wouldn’t have recognized this and wouldn’t know that he wanted correcting.

In actual fact, he would possibly even suppose he’s doing good with extra wins than losses.

In spite of everything, the biggest loss was solely -$295, which is nowhere close to the utmost lack of $830 doable for the unfold.

One drawback is that he didn’t have a particular exit loss set off in place.

He simply mentioned that he would exit the commerce if he “thinks” that the commerce wouldn’t come again into profitability.

That is too subjective, and is just too simple to have trades find yourself with massive losses.

Choices trades corresponding to this out-of-the-money credit score unfold are “excessive likelihood trades.”

That doesn’t imply excessive profitability trades.

It simply signifies that statistically, you should have extra wins than losses.

Simply because you might have extra wins than losses doesn’t imply you can be worthwhile, particularly should you don’t handle the dangers.

The lengthy protecting put isn’t going to handle the danger for you.

By the point this lengthy put caps the danger, the danger would have gotten so large as to wipe out 5 max win trades.

The one approach to be worthwhile is to cap the danger ourselves with our psychological cease loss and to exit the commerce on the acceptable loss degree.

Let’s assist this dealer develop into worthwhile by placing a rule in place to exit the commerce every time the loss exceeds twice the take-profit degree.

Since he had set his take-profit degree at $85, he would exit the commerce every time the loss reached $170 with out exception.

No extra saying, “I’ll give this commerce extra time as a result of the technical ranges say it ought to bounce.”

No extra saying, “I’ll make this one exception.”

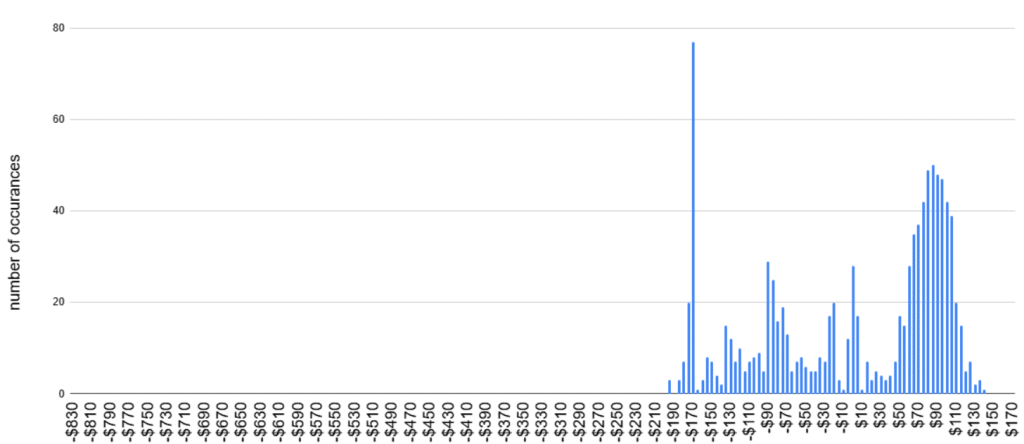

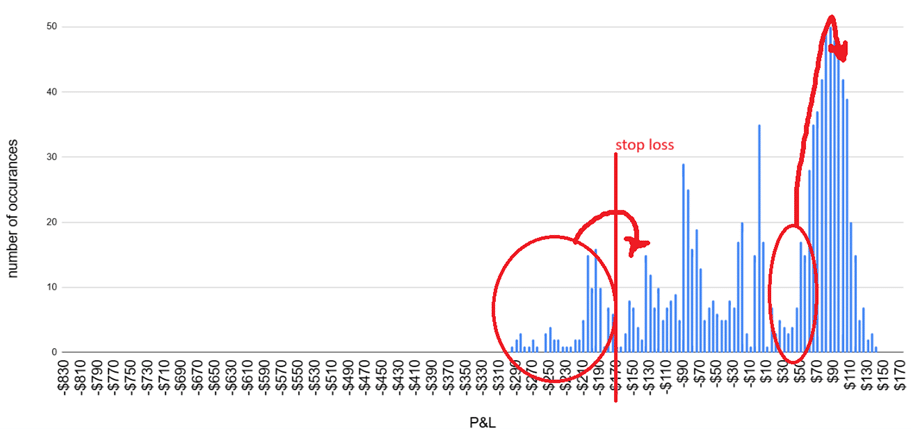

With this rule in place, the P&L revenue distribution would possibly seem like this:

What do you suppose?

Do you suppose this new distribution is worthwhile now or not?

There are a lot of shedding trades on the -$170 loss degree – 77 trades to be precise.

It is because all of the earlier trades with losses higher than $170 are being reduce brief and exited on the -$170 loss degree.

A number of trades exceeded the -$170 loss degree because of slippage, not being on the laptop, in a single day hole dangers, and so forth.

Nonetheless, there have been no trades that misplaced greater than -$195.

It’s true that whenever you tighten the cease loss, you’re going to get barely extra shedding trades.

As a result of among the beforehand shedding trades had come again to breakeven, you now have locked of their loss with out presumably returning to breakeven.

This time, the spreadsheet had 419 losses and 28 breakeven trades – extra losses and fewer breakeven trades:

We didn’t contact any of the 553 successful trades.

This new profile distribution is worthwhile.

Not by a lot (solely worthwhile by $215) – however worthwhile however.

Let’s see how we are able to make this dealer much more worthwhile.

Final time, many trades had income between $40 and $75.

It is because the dealer was taking income early.

If the commerce exhibits a $70 revenue, one has to ask why the dealer is closing the commerce earlier than hitting the revenue goal.

Typically, it’s essential to exit early because of technical points and altering circumstances.

It is actually because the dealer fears that the revenue will slip away.

As Peter Lynch mentioned in his 1989 ebook One Up On Wall Road:

“You received’t enhance outcomes by pulling out the flowers and watering the weeds.”

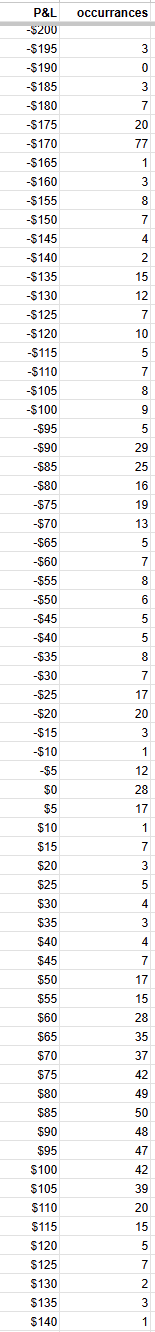

So, after the dealer educated himself to not take income early, that is the brand new P&L distribution:

Entry The Prime 5 Instruments For Choice Merchants

This time, the histogram has noticeable gaps across the $40 to $75 revenue ranges.

By holding these trades longer, a lot of them reached the $85 revenue goal degree.

It’s true that when a commerce is held longer, it’s extra prone to encounter an opposed occasion, and income can be misplaced.

Let’s say that on this hypothetical scenario, 4 of the trades have been like that.

Two of them had income that slipped to zero, and two of them slipped all the way in which to cease loss.

So now now we have two additional occurrences on the -$170 loss degree and two extra breakeven trades.

Nonetheless, many extra trades confirmed up on the $85 revenue goal.

The ensuing tally is that there have been 421 shedding trades, 30 breakeven trades, and 549 successful trades.

This final profile had extra shedding trades and fewer successful trades than the earlier two.

Do you suppose this can be a worthwhile distribution?

Nicely, it’s, and it’s the most worthwhile of the three.

The online revenue from the 1000 trades is $1200.

As illustrated by our instance, one facet of choices buying and selling danger administration is to chop losses brief and let winners run.

However as everyone knows, buying and selling isn’t so simple as that.

There may be all the time a stability.

We can’t set our cease losses too tight or let our winners run eternally.

We have to observe our wins and losses to search out that stability.

It’s possible you’ll not must go so far as graphing it out in a histogram.

However at the very least know the quantity and measurement of wins to the losses.

And don’t let the losses be an excessive amount of larger than the wins.

By “larger,” I don’t imply simply the greenback quantity; it’s the mixture of the quantity and the scale of the loss.

Firstly, in choices buying and selling, danger administration is to get rid of massive losses.

You will have most likely heard this elsewhere earlier than.

However did they present you the P&L distribution curve?

No?

Nicely, maybe that may be a good factor.

Since you noticed it right here might provide you with an edge over those that haven’t seen it.

By visually seeing this idea in motion through the P&L distribution curve, you perceive why chopping these losses is important.

You’re chopping off the left tail of the distribution curve.

And you might be shifting the majority of the histogram to the proper aspect.

And that’s how you can reshape the P&L distribution curve to develop into worthwhile.

We hope you loved this text on choices buying and selling danger administration.

In case you have any questions, please ship an e-mail or depart a remark beneath.

Coated Name Calculator Obtain

Commerce protected!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who will not be accustomed to change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.