Merchants,

We’ve acquired a shortened week developing, with an early shut on Thursday and Friday, the markets are closed. Traditionally, throughout this era, I’ve seen a number of outlier strikes with small caps, and within the latter a part of the week, some lack of follow-through with massive caps, for apparent causes. Simply one thing to bear in mind as we method this shortened vacation week.

With that in thoughts, listed below are a few of my prime concepts for the week, together with outlines of superb entry and exit eventualities.

A reasonably prolonged listing this week with a bunch of names on watch, so I’ll preserve it briefer than common beneath every concept.

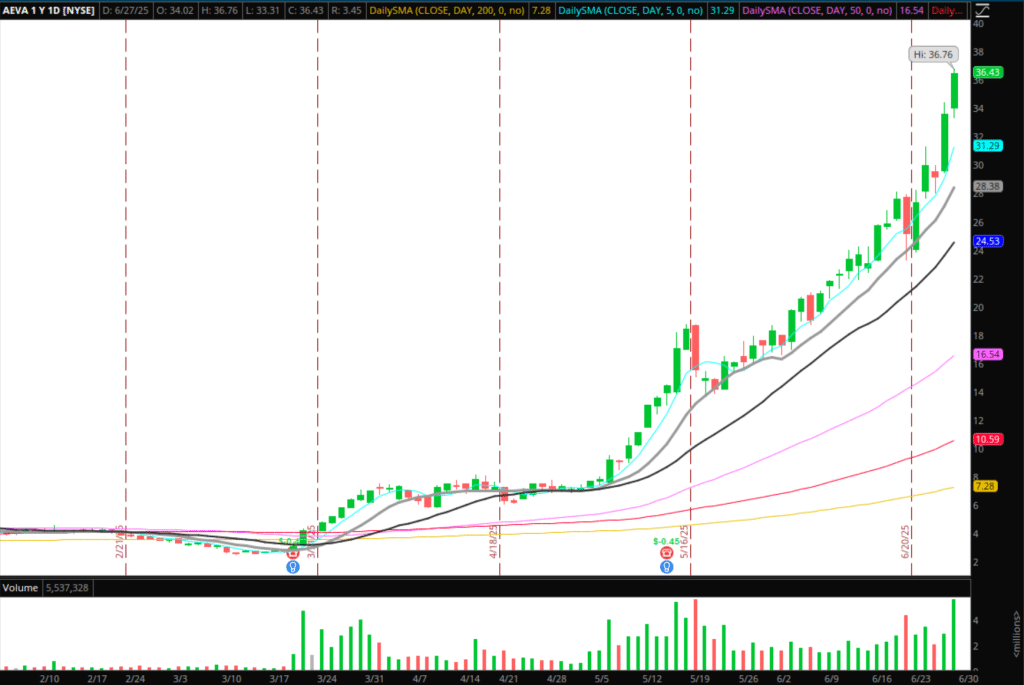

Exhaustion / Failed Comply with-By in AEVA

Distinctive transfer greater this 12 months, up nearly 700% on the 12 months as of Friday’s shut. Lastly, with RSI within the 80s and quantity and vary growth persevering with into the top of final week, it’s nearing a possible brief alternative.

As at all times with such a possibility, I’m not seeking to be early. I’d wish to see follow-through to the upside fail, because the inventory will get vertical on the next timeframe. What I imply by that’s I’d wish to see a niche fail to carry, and the inventory open pink for a FRD setup. Alternatively, I’d wish to see a niche up, with exhaustion greater within the morning, concentrating on a decrease excessive or a consolidation breakdown for a brief entry. Lastly, an intraday parabolic and exhaustion transfer, the place I’d then look to brief put up a quantity trade. I wouldn’t be in search of a brief place to last more than as much as two days right here, doubtlessly concentrating on a retracement towards the 5-day / low $30s, relying on the setup.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

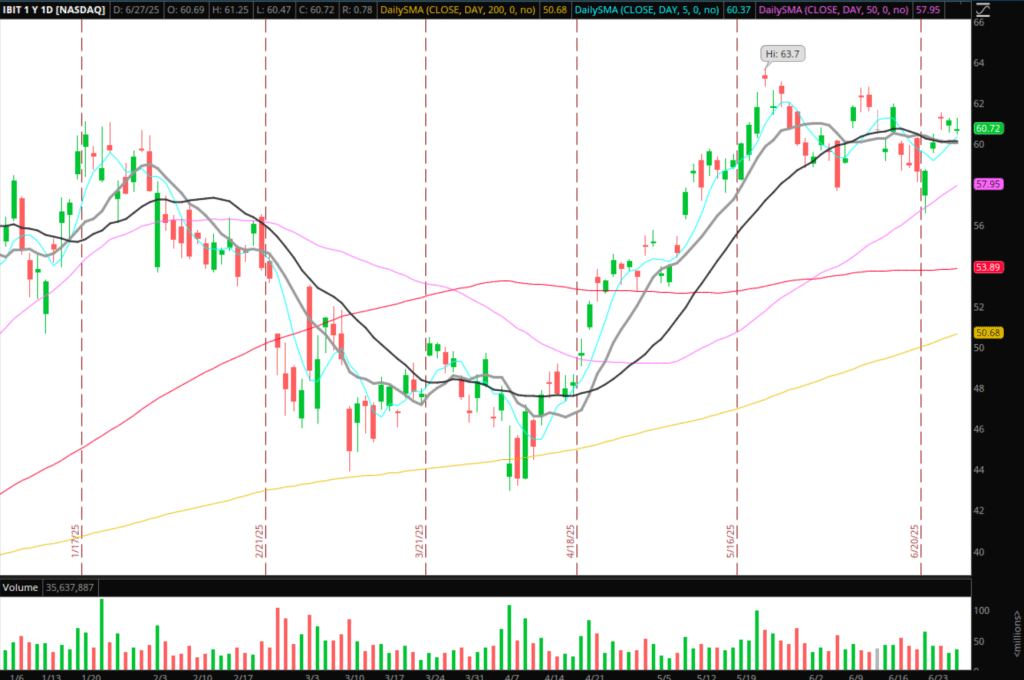

Breakout in Bitcoin / IBIT

Simple technical setup forming in IBIT / Bitcoin, with a beautiful bull flag close to highs. 10 and 20-day acted as assist for many of final week. I’ll be preserving an in depth eye on IBIT to see if it might push above final week’s excessive and maintain over $62 for a possible momo entry concentrating on a transfer towards the highs, with a LOD cease. Ought to the vary open up and it experiences some follow-through, I’d be open to the next timeframe swing.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

Consolidation Breakout in NBIS

Very comparable plans to final week in NBIS. It continues to base extraordinarily nicely inside attain of highs. The stuff on Wednesday, adopted by a pointy reclaim, solely will get me extra bullish for follow-through if this have been to push over $54. So, just like final week, I’d be in search of a momentum lengthy above $54 for a breakout to new highs.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

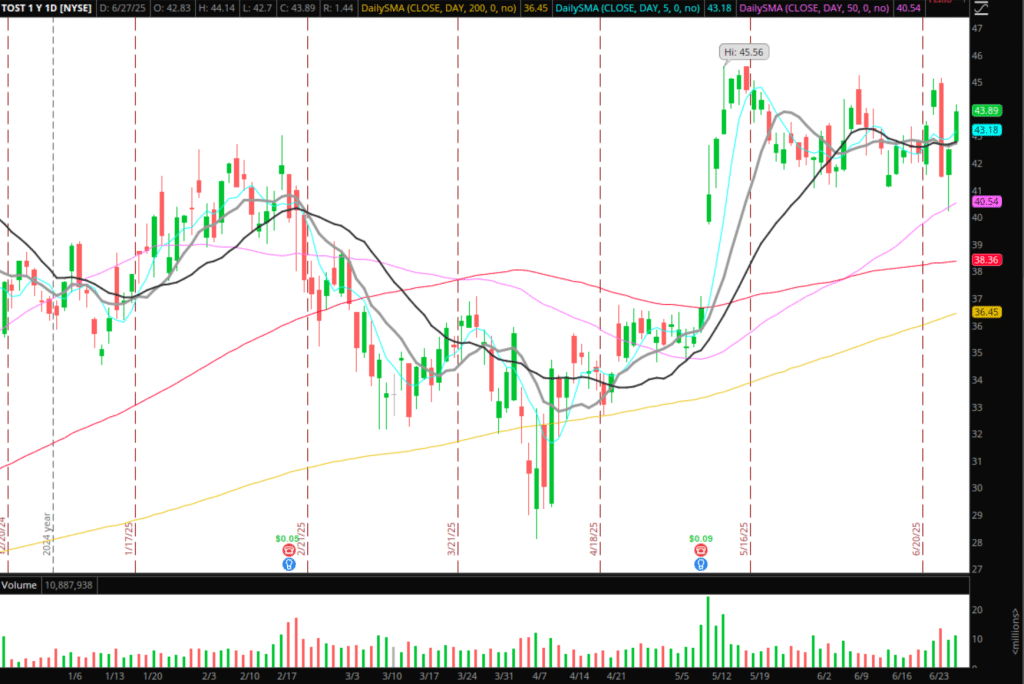

Consolidation Breakout in TOST

Much like NBIS, after the failed transfer decrease final week, that is on look ahead to a transfer greater above final week’s excessive close to $45. If this clears the KL and bases above, indicating robust shopping for curiosity and newfound assist, I’d search for an extended entry versus the day’s low, and open to an extended swing.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

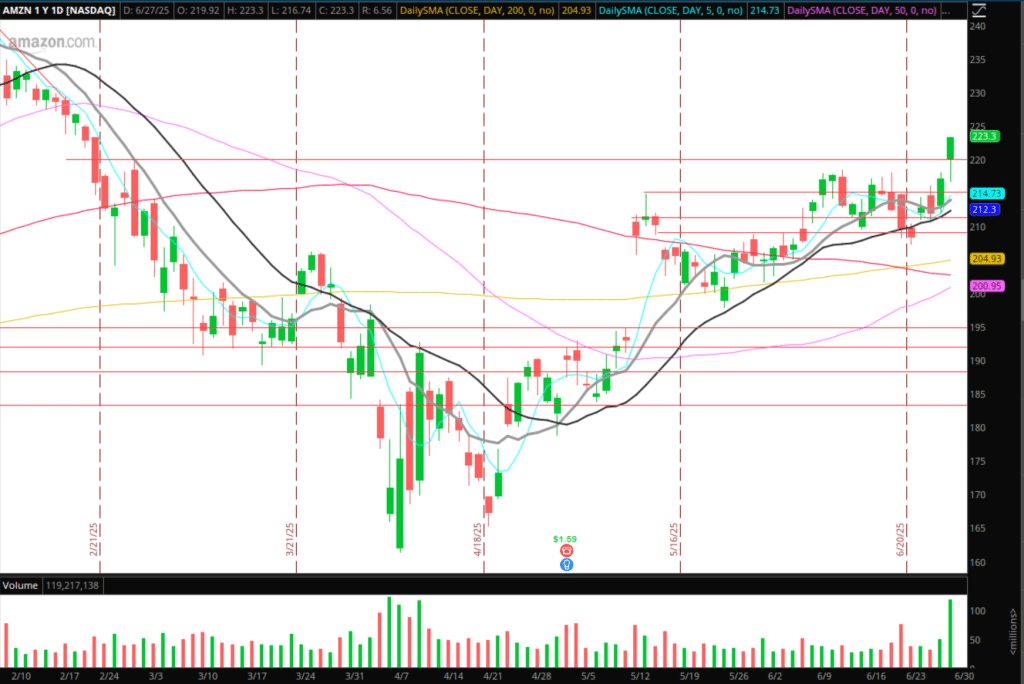

Continuation in AMZN

The perfect entry in AMZN was on Friday over $220 versus the day’s low for an extended swing. Nevertheless, if the inventory pulls into the low $220s, confirms the next low, and resistance turns into assist, that would present one other superb entry level for an extended swing. XLY had a beautiful breakout with AMZN being the highest holding of the discretionary ETF—one other potential car for the concept.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

And lastly, extra backburner concepts:

LCFY – Small float and respectable endurance on Friday. I’ll have alerts set in case this pushes again towards provide close to $10 and fails to observe by means of for a reactive brief. Alternatively, for midweek, it’d qualify for a possible liquidity entice if it reclaims $11 – $12, the place I’d be open to an extended intraday.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

CYN – On look ahead to a possible day 3 if it pushes again into the low $20s and stuffs for a reactive intraday brief.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures