Up to date on July twenty fifth, 2025 by Bob Ciura

Blue-chip shares are established, financially robust, and constantly worthwhile publicly traded corporations.

Their power makes them interesting investments for comparatively secure, dependable dividends and capital appreciation versus much less established shares.

This analysis report has the next sources that can assist you spend money on blue chip shares:

Useful resource #1: The Blue Chip Shares Spreadsheet Checklist

There are at present greater than 500 securities in our blue chip shares checklist.

We categorize blue chip shares as corporations which can be members of 1 or extra of the next 3 lists:

Merely put, blue chip shares have no less than 10 consecutive years of dividend will increase.

On the similar time, we regularly suggest revenue traders take into account excessive dividend shares, for his or her elevated dividend yields.

Excessive dividend shares means extra revenue for each greenback invested. All different issues equal, the upper the dividend yield, the higher.

The mix of dividend yield and development, may end up in excellent long-term returns.

On this analysis report, we analyze 10 blue chip shares with excessive dividend yields of 5.0% and larger.

The checklist is sorted by dividend yield, in ascending order.

Desk of Contents

The desk of contents beneath permits for straightforward navigation.

Excessive Yield Blue Chip #10: Getty Realty (GTY)

Dividend Historical past: 12 years of consecutive will increase

Dividend Yield: 6.8%

Getty Realty is an actual property funding belief (REIT) that makes a speciality of the acquisition and improvement of comfort, automotive and different single-tenant retail actual property. The REIT has 1,119 properties in 42 states throughout the U.S. About 67% of the properties are comfort and fuel shops.

Getty Realty has a defensive enterprise mannequin, as its tenants are established retailers which can be immune to recessions and the specter of e-commerce.

Practically 70% of the properties of the REIT are nook areas in excessive density metropolitan areas. As well as, the REIT has an eye-opening occupancy fee of 99.7%.

In late April, Getty Realty reported (4/23/25) monetary outcomes for the primary quarter of fiscal 2025. Rental revenue grew 13% over the prior 12 months’s quarter because of the acquisition of recent properties and development in rental charges.

Adjusted funds from operations (AFFO) per share grew solely 3%, from $0.57 to $0.59, as a consequence of larger curiosity expense and elevated depreciation as a result of acquisition of many new properties.

In distinction to most REITs, that are affected by excessive curiosity expense amid almost 23-year excessive rates of interest, Getty Realty has low curiosity expense because of its wholesome steadiness sheet. Administration reiterated its steering for AFFO per-share of $2.38-$2.41 in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on GTY (preview of web page 1 of three proven beneath):

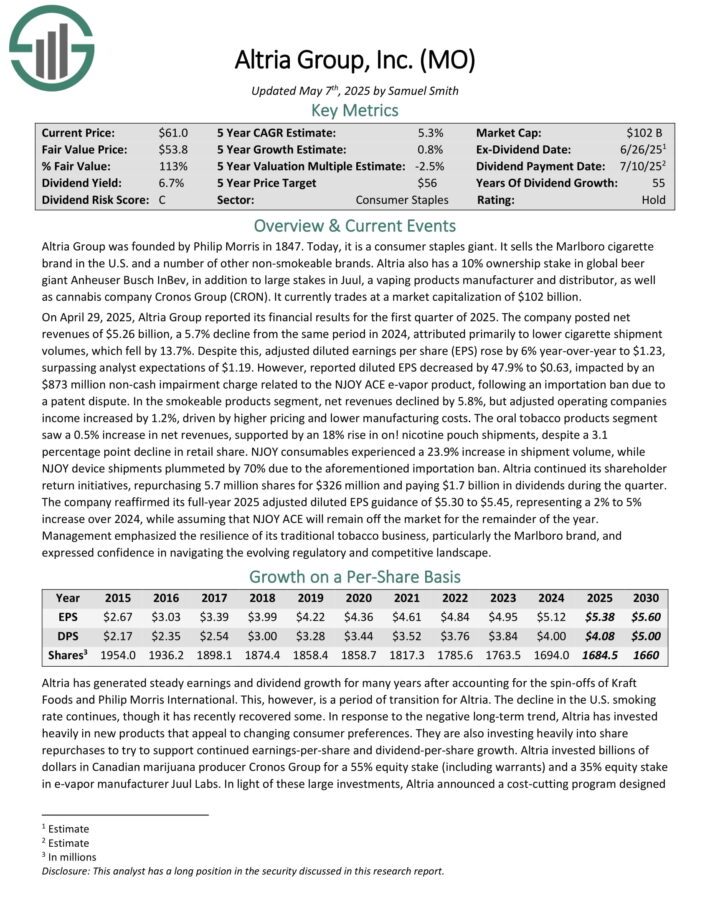

Excessive Yield Blue Chip #9: Altria Group (MO)

Dividend Historical past: 55 years of consecutive will increase

Dividend Yield: 6.9%

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

With a present dividend yield of almost 8%, Altria is a perfect retirement funding inventory.

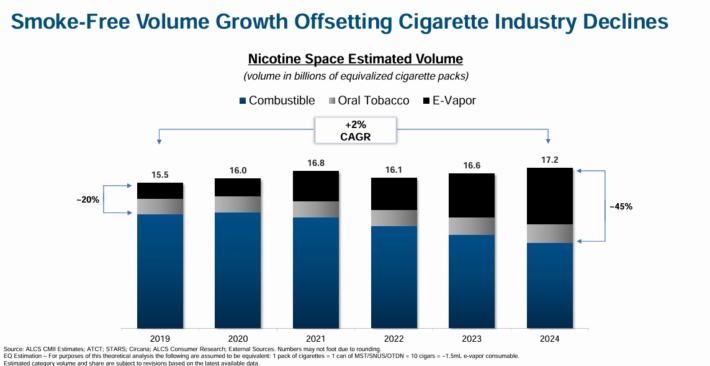

This can be a interval of transition for Altria. The decline within the U.S. smoking fee continues. In response, Altria has invested closely in new merchandise that attraction to altering shopper preferences, because the smoke-free class continues to develop.

Supply: Investor Presentation

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On April 29, 2025, Altria Group reported its monetary outcomes for the primary quarter of 2025. The corporate posted internet revenues of $5.26 billion, a 5.7% decline from the identical interval in 2024, attributed primarily to decrease cigarette cargo volumes, which fell by 13.7%.

Regardless of this, adjusted diluted earnings per share (EPS) rose by 6% year-over-year to $1.23, surpassing analyst expectations of $1.19.

Within the smokeable merchandise section, internet revenues declined by 5.8%, however adjusted working corporations revenue elevated by 1.2%, pushed by larger pricing and decrease manufacturing prices.

The oral tobacco merchandise section noticed a 0.5% enhance in internet revenues, supported by an 18% rise in on! nicotine pouch shipments.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven beneath):

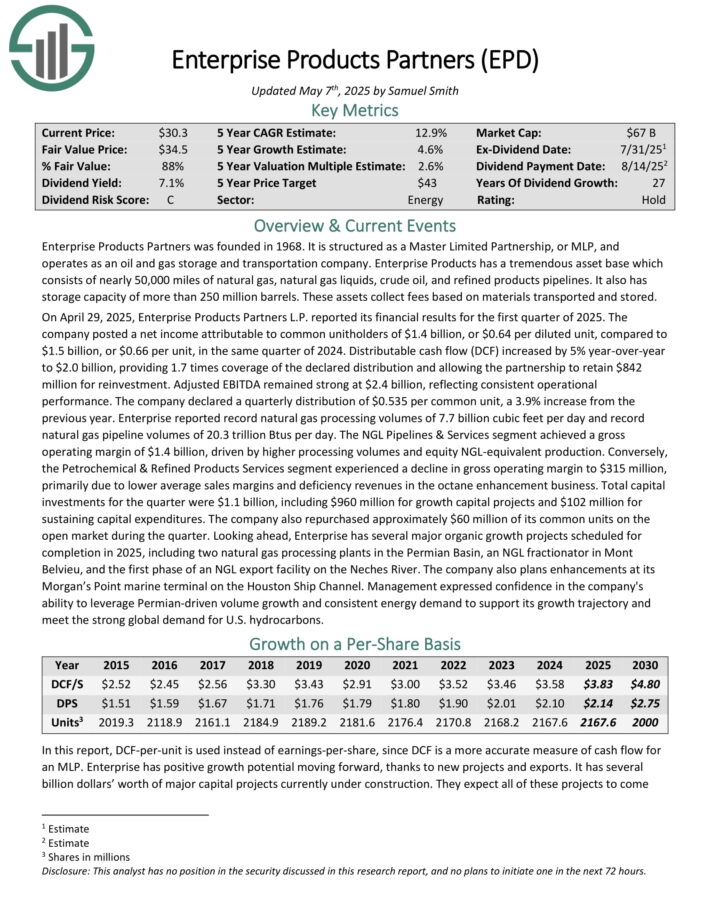

Excessive Yield Blue Chip #8: Enterprise Merchandise Companions LP (EPD)

Dividend Historical past: 28 years of consecutive will increase

Dividend Yield: 6.9%

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and fuel storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure fuel, pure fuel liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These property accumulate charges primarily based on volumes of supplies transported and saved.

Supply: Investor Presentation

On April 29, 2025, Enterprise Merchandise Companions L.P. reported its monetary outcomes for the primary quarter of 2025. The corporate posted a internet revenue attributable to widespread unitholders of $1.4 billion, or $0.64 per diluted unit, in comparison with $1.5 billion, or $0.66 per unit, in the identical quarter of 2024.

Distributable money circulation (DCF) elevated by 5% year-over-year to $2.0 billion, offering 1.7 instances protection of the declared distribution and permitting the partnership to retain $842 million for reinvestment.

Adjusted EBITDA remained robust at $2.4 billion, reflecting constant operational efficiency. The corporate declared a quarterly distribution of $0.535 per widespread unit, a 3.9% enhance from the earlier 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPD (preview of web page 1 of three proven beneath):

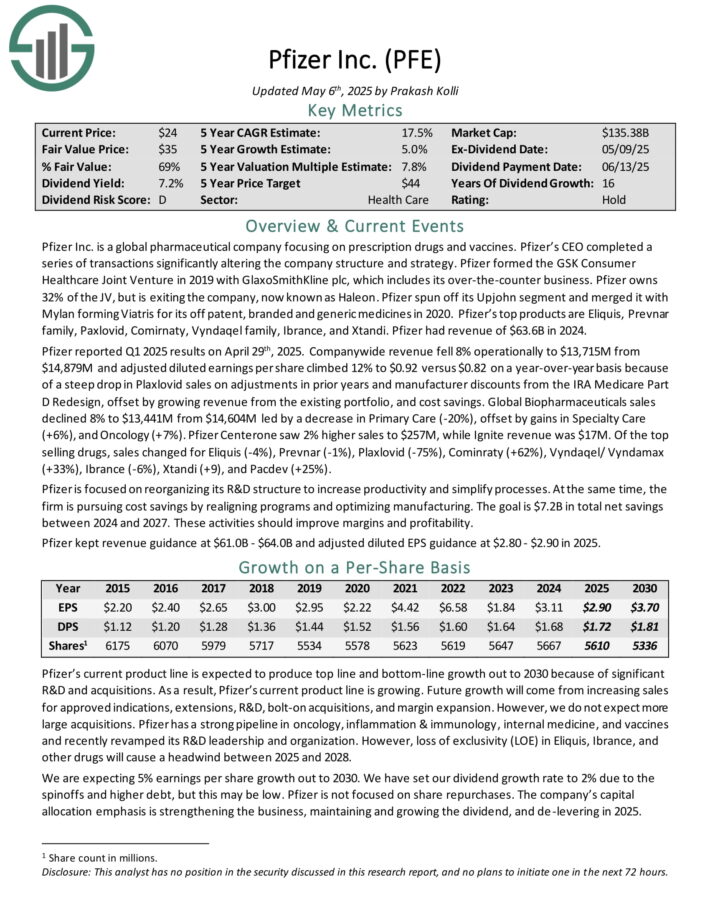

Excessive Yield Blue Chip #7: Pfizer Inc. (PFE)

Dividend Historical past: 16 years of consecutive will increase

Dividend Yield: 6.9%

Pfizer Inc. is a worldwide pharmaceutical firm specializing in prescribed drugs and vaccines. Pfizer’s high merchandise are Eliquis, Prevnar household, Paxlovid, Comirnaty, Vyndaqel household, Ibrance, and Xtandi. Pfizer had income of $63.6B in 2024.

Pfizer reported Q1 2025 outcomes on April twenty ninth, 2025. Firm-wide income fell 8% operationally and adjusted diluted earnings per share climbed 12% to $0.92 versus $0.82 on a year-over-year foundation.

The income decline was due to a steep drop in Plaxlovid gross sales on changes in prior years and producer reductions from the IRA Medicare Half D Redesign, offset by rising income from the prevailing portfolio, and value financial savings.

World Biopharmaceuticals gross sales declined 8% led by a lower in Major Care (-20%), offset by positive factors in Specialty Care (+6%), and Oncology (+7%).

Click on right here to obtain our most up-to-date Positive Evaluation report on PFE (preview of web page 1 of three proven beneath):

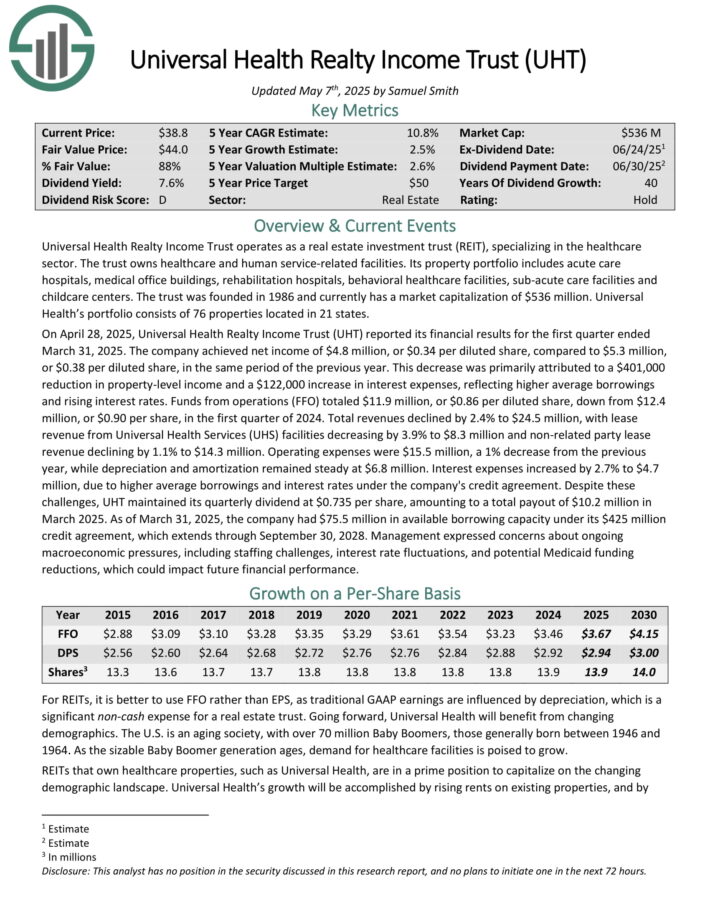

Excessive Yield Blue Chip #6: Common Well being Realty Earnings Belief (UHT)

Dividend Historical past: 41 years of consecutive will increase

Dividend Yield: 7.1%

Common Well being Realty Earnings Belief operates as an actual property funding belief (REIT), specializing within the healthcare sector. The belief owns healthcare and human service-related services.

Its property portfolio consists of acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare services, sub-acute care services and childcare facilities.

Common Well being’s portfolio consists of 76 properties positioned in 21 states.

On April 28, 2025, Common Well being Realty Earnings Belief (UHT) reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved internet revenue of $4.8 million, or $0.34 per diluted share, in comparison with $5.3 million, or $0.38 per diluted share, in the identical interval of the earlier 12 months.

This lower was primarily attributed to a $401,000 discount in property-level revenue and a $122,000 enhance in curiosity bills, reflecting larger common borrowings and rising rates of interest.

Funds from operations (FFO) totaled $11.9 million, or $0.86 per diluted share, down from $12.4 million, or $0.90 per share, within the first quarter of 2024. Complete revenues declined by 2.4%.

Click on right here to obtain our most up-to-date Positive Evaluation report on UHT (preview of web page 1 of three proven beneath):

Excessive Yield Blue Chip #5: Telus Corp. (TU)

Dividend Historical past: 22 years of consecutive will increase

Dividend Yield: 7.2%

TELUS Company is likely one of the ‘huge three’ Canadian telecommunications corporations. TELUS is concentrated in Western Canada and offers a full vary of communication services by two enterprise segments: Wireline and Wi-fi.

In early Might, TELUS reported (5/9/25) monetary outcomes for the primary quarter of fiscal 2025. The corporate posted first rate buyer development. It posted complete cell buyer development of 218,000, development of fastened clients by 9,000 and an industry-leading churn fee of 0.84% at its postpaid cell enterprise.

Income grew 3% because of larger service revenues in TELUS digital expertise section. Earnings-per-share remained flat at $0.19, principally as a consequence of thinner working margins.

Click on right here to obtain our most up-to-date Positive Evaluation report on TU (preview of web page 1 of three proven beneath):

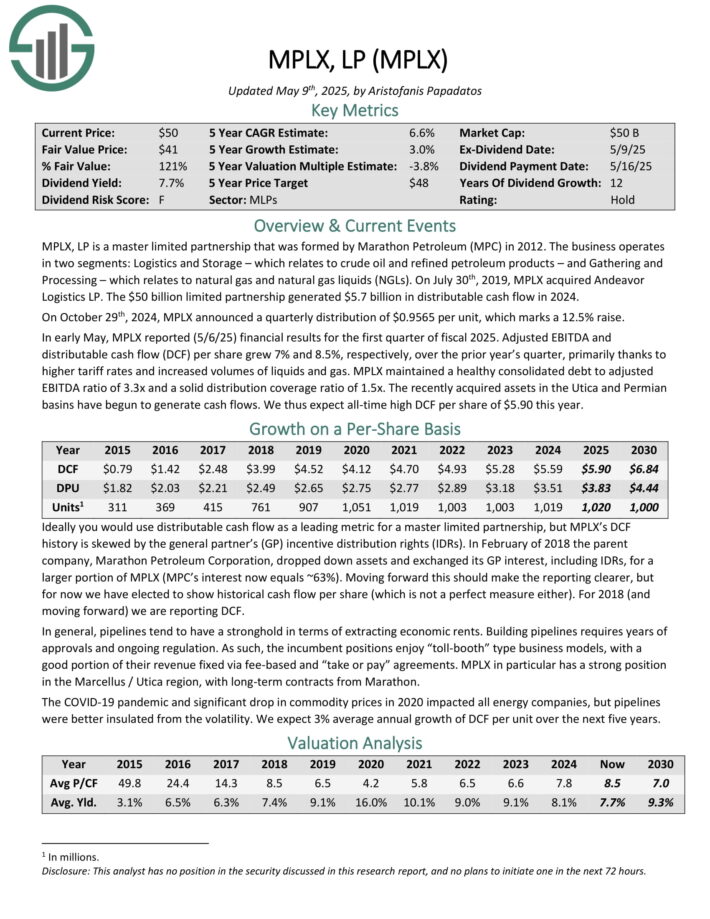

Excessive Yield Blue Chip #4: MPLX LP (MPLX)

Dividend Historical past: 12 years of consecutive will increase

Dividend Yield: 7.5%

MPLX LP is a Grasp Restricted Partnership that was shaped by the Marathon Petroleum Company (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The enterprise operates in two segments:

Logistics and Storage, which pertains to crude oil and refined petroleum merchandise

Gathering and Processing, which pertains to pure fuel and pure fuel liquids (NGLs)

In early Might, MPLX reported (5/6/25) monetary outcomes for the primary quarter of fiscal 2025. Adjusted EBITDA and distributable money circulation (DCF) per share grew 7% and eight.5%, respectively, over the prior 12 months’s quarter, primarily because of larger tariff charges and elevated volumes of liquids and fuel.

MPLX maintained a wholesome consolidated debt to adjusted EBITDA ratio of three.3x and a strong distribution protection ratio of 1.5x.

Click on right here to obtain our most up-to-date Positive Evaluation report on MPLX (preview of web page 1 of three proven beneath):

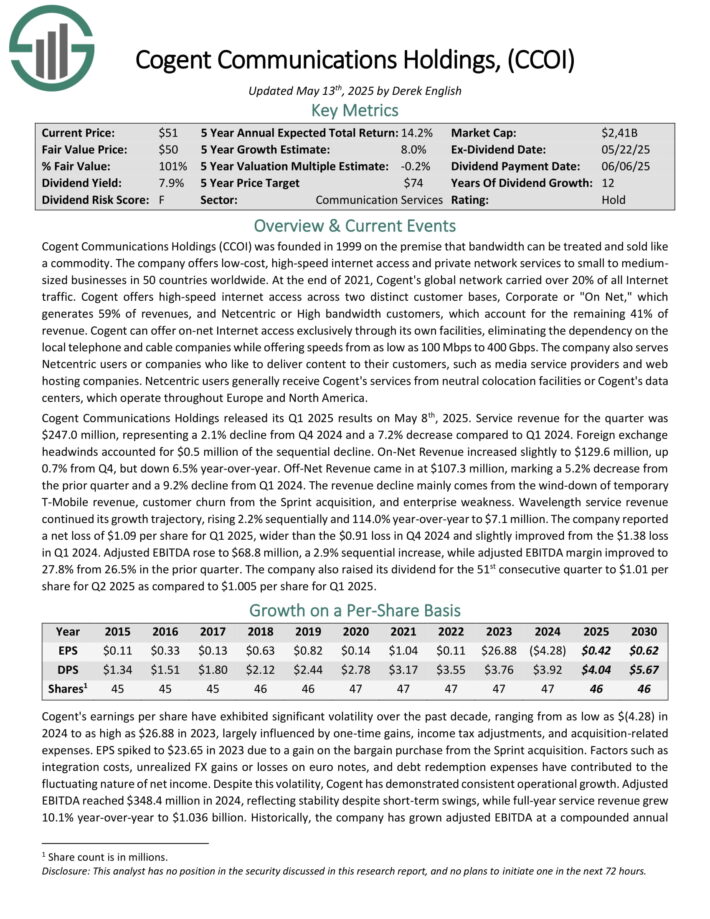

Excessive Yield Blue Chip #3: Cogent Communications Holdings (CCOI)

Dividend Historical past: 12 years of consecutive will increase

Dividend Yield: 8.3%

Cogent Communications Holdings (CCOI) was based in 1999 on the premise that bandwidth could be handled and offered like a commodity. The corporate gives low-cost, high-speed web entry and personal community companies to small to medium-sized companies in 50 international locations worldwide.

Cogent gives high-speed web entry throughout two distinct buyer bases, Company or “On Web,” which generates 59% of revenues, and Netcentric or Excessive bandwidth clients, which account for the remaining 41% of income.

Cogent can supply on-net Web entry solely by its personal services, eliminating the dependency on the native phone and cable corporations whereas providing speeds from as little as 100 Mbps to 400 Gbps.

The corporate additionally serves Netcentric customers or corporations who prefer to ship content material to their clients, resembling media service suppliers and hosting corporations.

Cogent Communications Holdings launched its Q1 2025 outcomes on Might eighth, 2025. Service income for the quarter was $247.0 million, representing a 2.1% decline from This fall 2024 and a 7.2% lower in comparison with Q1 2024. Overseas alternate headwinds accounted for $0.5 million of the sequential decline.

On-Web Income elevated barely to $129.6 million, up 0.7% from This fall, however down 6.5% year-over-year. Off-Web Income got here in at $107.3 million, marking a 5.2% lower from the prior quarter and a 9.2% decline from Q1 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on CCOI (preview of web page 1 of three proven beneath):

Excessive Yield Blue Chip #2: LyondellBasell Industries (LYB)

Dividend Historical past: 13 years of consecutive will increase

Dividend Yield: 8.8%

LyondellBasell is one the most important plastics, chemical compounds and refining corporations on the planet. The corporate offers supplies and merchandise that assist advance options for meals security, water purity, gas effectivity of automobiles, and performance in electronics and home equipment.

LyondellBasell sells merchandise in additional than 100 international locations and is the world’s largest producer of polymer compounds. The corporate, with U.S operations headquartered in Houston, Texas and world operations headquartered in London, generated $40.3 billion in gross sales final 12 months.

On April twenty sixth, 2025, LyondellBasell posted its Q1 outcomes for the interval ending March thirty first, 2025. The corporate posted revenues of $9.18 billion, marking a sequential decline from $9.45 billion in This fall, as a consequence of downtime impacts, decrease volumes, and compressed margins throughout a number of key segments.

The corporate posted adjusted EBITDA of $576 million, down from $687 million in This fall, reflecting larger feedstock and vitality prices, lowered polyolefin margins, and decrease licensing revenues.

Adjusted internet revenue for Q1 was $169 million ($0.52 per share), down from $249 million ($0.75) in This fall.

Click on right here to obtain our most up-to-date Positive Evaluation report on LYB (preview of web page 1 of three proven beneath):

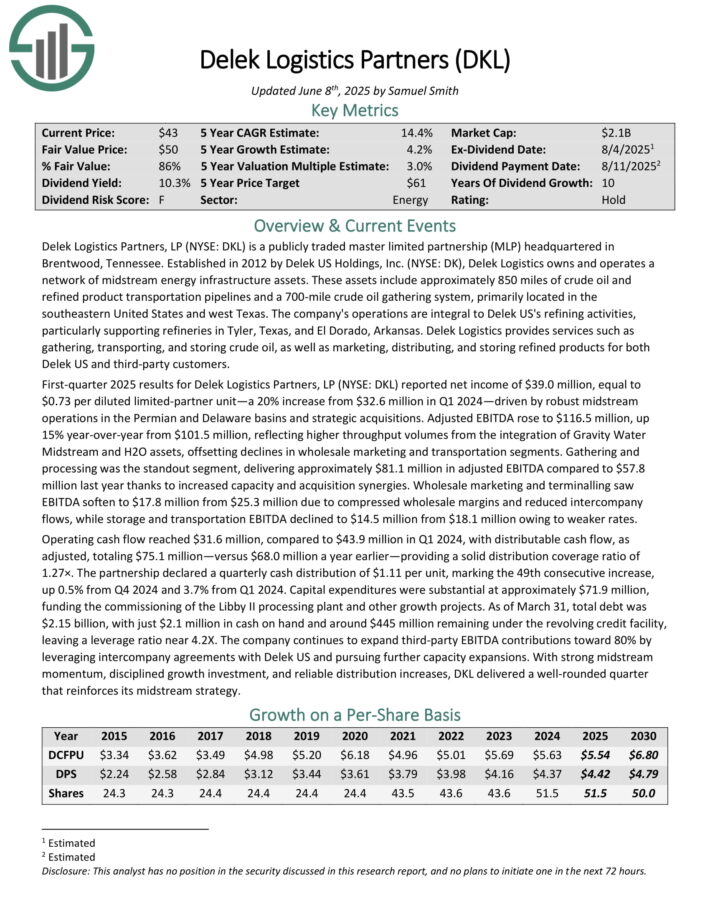

Excessive Yield Blue Chip #1: Delek Logistics Companions LP (DKL)

Dividend Historical past: 10 years of consecutive will increase

Dividend Yield: 10.1%

Delek Logistics Companions, LP is a publicly traded grasp restricted partnership (MLP) headquartered in Brentwood, Tennessee. Established in 2012 by Delek US Holdings, Inc. (NYSE: DK), Delek Logistics owns and operates a community of midstream vitality infrastructure property.

These property embody roughly 850 miles of crude oil and refined product transportation pipelines and a 700-mile crude oil gathering system, primarily positioned within the southeastern United States and west Texas.

The corporate’s operations are integral to Delek US’s refining actions, notably supporting refineries in Tyler, Texas, and El Dorado, Arkansas.

Delek Logistics offers companies resembling gathering, transporting, and storing crude oil, in addition to advertising, distributing, and storing refined merchandise for each Delek US and third-party clients.

First-quarter 2025 outcomes for Delek Logistics Companions, LP reported internet revenue of $39.0 million, equal to $0.73 per diluted limited-partner unit—a 20% enhance from $32.6 million in Q1 2024—pushed by sturdy midstream operations within the Permian and Delaware basins and strategic acquisitions.

Adjusted EBITDA rose to $116.5 million, up 15% year-over-year from $101.5 million, reflecting larger throughput volumes from the mixing of Gravity Water Midstream and H2O property, offsetting declines in wholesale advertising and transportation segments.

Click on right here to obtain our most up-to-date Positive Evaluation report on DKL (preview of web page 1 of three proven beneath):

Further Studying

If you’re considering discovering different high-yield securities, the next Positive Dividend sources could also be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.