Up to date on August twentieth, 2025 by Bob Ciura

On the earth of investing, volatility issues. Buyers are reminded of this each time there’s a downturn within the broader market and particular person shares which can be extra risky than others expertise huge swings in value.

Volatility is a proxy for danger; extra volatility typically means a riskier portfolio. The volatility of a safety or portfolio in opposition to a benchmark known as Beta.

Briefly, Beta is measured by way of a components that calculates the value danger of a safety or portfolio in opposition to a benchmark, which is often the broader market as measured by the S&P 500.

Right here’s the best way to learn inventory betas:

A beta of 1.0 means the inventory strikes equally with the S&P 500

A beta of two.0 means the inventory strikes twice as a lot because the S&P 500

A beta of 0.0 means the shares strikes don’t correlate with the S&P 500

A beta of -1.0 means the inventory strikes exactly reverse the S&P 500

Apparently, low beta shares have traditionally outperformed the market… However extra on that later.

You may obtain a spreadsheet of the 100 lowest beta S&P shares (together with essential monetary metrics like price-to-earnings ratios and dividend yields) beneath:

This text will talk about beta extra completely, why low-beta shares are likely to outperform, and supply a dialogue of the 5 lowest-beta dividend shares within the Positive Evaluation Analysis Database.

The desk of contents beneath permits for straightforward navigation.

Desk of Contents

The Proof for Low Beta Shares Outperformance

Beta is useful in understanding the general value danger stage for buyers throughout market downturns specifically. The decrease the Beta worth, the much less volatility the inventory or portfolio ought to exhibit in opposition to the benchmark.

That is helpful for buyers for apparent causes, significantly these which can be near or already in retirement, as drawdowns ought to be comparatively restricted in opposition to the benchmark.

Importantly, low or excessive Beta merely measures the scale of the strikes a safety makes; it doesn’t imply essentially that the value of the safety stays practically fixed.

Securities might be low Beta and nonetheless be caught in long-term downtrends, so that is merely yet another instrument buyers can use when constructing a portfolio.

The traditional knowledge would counsel that decrease Beta shares ought to underperform the broader markets throughout uptrends and outperform throughout downtrends, providing buyers decrease potential returns in alternate for decrease danger.

Nonetheless, historical past would counsel that merely isn’t the case.

Certainly, this paper from Harvard Enterprise Faculty means that not solely do low Beta shares not underperform the broader market over time – together with all market circumstances – they really outperform.

An extended-term research whereby the shares with the bottom 30% of Beta scores within the US have been pitted in opposition to shares with the very best 30% of Beta scores prompt that low Beta shares outperform by a number of proportion factors yearly.

Over time, this kind of outperformance can imply the distinction between a snug retirement and having to proceed working.

Whereas low Beta shares aren’t a panacea, the case for his or her outperformance over time – and with decrease danger – is kind of compelling.

How To Calculate Beta

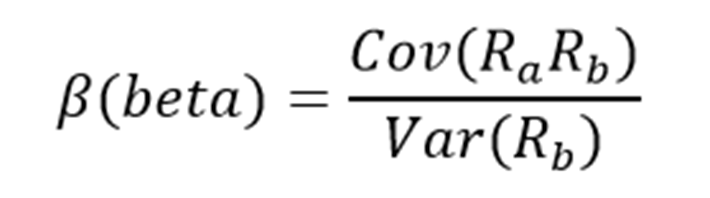

The components to calculate a safety’s Beta is pretty easy. The end result, expressed as a quantity, reveals the safety’s tendency to maneuver with the benchmark.

For instance, a Beta worth of 1.0 signifies that the safety in query ought to transfer in lockstep with the benchmark. A Beta of two.0 signifies that strikes within the safety ought to be twice as giant in magnitude because the benchmark and in the identical route, whereas a unfavourable Beta signifies that actions within the safety and benchmark have a tendency to maneuver in reverse instructions or are negatively correlated.

Associated: The S&P 500 Inventory With Destructive Beta.

In different phrases, negatively correlated securities could be anticipated to rise when the general market falls, or vice versa. A small worth of Beta (one thing lower than 1.0) signifies a inventory that strikes in the identical route because the benchmark, however with smaller relative modifications.

Right here’s a have a look at the components:

The numerator is the covariance of the asset in query with the market, whereas the denominator is the variance of the market. These complicated-sounding variables aren’t really that troublesome to compute – particularly in Excel.

Moreover, Beta may also be calculated because the correlation coefficient of the safety in query and the market, multiplied by the safety’s normal deviation divided by the market’s normal deviation.

Lastly, there’s a drastically simplified technique to calculate Beta by manipulating the capital asset pricing mannequin components (extra on Beta and the capital asset pricing mannequin later on this article).

Right here’s an instance of the information you’ll have to calculate Beta:

Threat-free fee (usually Treasuries a minimum of two years out)

Your asset’s fee of return over some interval (usually one 12 months to 5 years)

Your benchmark’s fee of return over the identical interval because the asset

To indicate the best way to use these variables to do the calculation of Beta, we’ll assume a risk-free fee of two%, our inventory’s fee of return of seven% and the benchmark’s fee of return of 8%.

You begin by subtracting the risk-free fee of return from each the safety in query and the benchmark. On this case, our asset’s fee of return internet of the risk-free fee could be 5% (7% – 2%).

The identical calculation for the benchmark would yield 6% (8% – 2%).

These two numbers – 5% and 6%, respectively – are the numerator and denominator for the Beta components. 5 divided by six yields a worth of 0.83, and that’s the Beta for this hypothetical safety.

On common, we’d count on an asset with this Beta worth to be 83% as risky because the benchmark.

Excited about it one other method, this asset ought to be about 17% much less risky than the benchmark whereas nonetheless having its anticipated returns correlated in the identical route.

Beta & The Capital Asset Pricing Mannequin (CAPM)

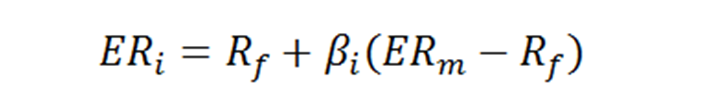

The Capital Asset Pricing Mannequin, or CAPM, is a typical investing components that makes use of the Beta calculation to account for the time worth of cash in addition to the risk-adjusted returns anticipated for a specific asset.

Beta is an integral part of the CAPM as a result of with out it, riskier securities would seem extra favorable to potential buyers. Their danger wouldn’t be accounted for within the calculation.

The CAPM components is as follows:

The variables are outlined as:

ERi = Anticipated return of funding

Rf = Threat-free fee

βi = Beta of the funding

ERm = Anticipated return of market

The chance-free fee is similar as within the Beta components, whereas the Beta that you simply’ve already calculated is solely positioned into the CAPM components. The anticipated return of the market (or benchmark) is positioned into the parentheses with the market danger premium, which can be from the Beta components. That is the anticipated benchmark’s return minus the risk-free fee.

To proceed our instance, right here is how the CAPM really works:

ER = 2% + 0.83(8% – 2%)

On this case, our safety has an anticipated return of 6.98% in opposition to an anticipated benchmark return of 8%. That could be okay relying upon the investor’s targets because the safety in query ought to expertise much less volatility than the market because of its Beta of lower than 1.

Whereas the CAPM actually isn’t good, it’s comparatively simple to calculate and offers buyers a way of comparability between two funding options.

Now, we’ll check out 5 shares that not solely provide buyers low Beta scores, however enticing potential returns as nicely.

Evaluation On The High 5 Low Beta Shares

The next 5 low beta shares have the bottom (however optimistic) Beta values, in ascending order from lowest to highest. In addition they pay dividends to shareholders.

We centered on Betas above 0, as we’re nonetheless searching for shares which can be positively correlated with the broader market:

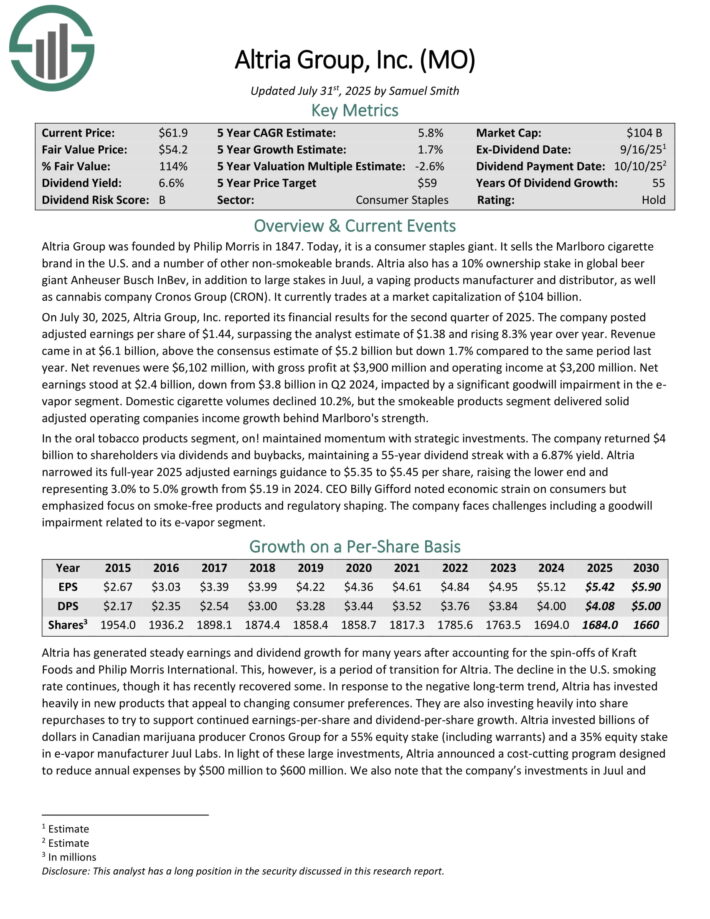

5. Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

It is a interval of transition for Altria. The decline within the U.S. smoking fee continues. In response, Altria has invested closely in new merchandise that enchantment to altering shopper preferences, because the smoke-free class continues to develop.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% 12 months over 12 months.

Income got here in at $6.1 billion, above the consensus estimate of $5.2 billion however down 1.7% in comparison with the identical interval final 12 months. Web revenues have been $6,102 million, with gross revenue at $3,900 million and working revenue at $3,200 million.

Web earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a big goodwill impairment within the e-vapor phase.

Home cigarette volumes declined 10.2%, however the smokeable merchandise phase delivered strong adjusted working corporations revenue development behind Marlboro’s energy.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven beneath):

4. Humana Inc. (HUM)

Humana is without doubt one of the largest personal well being insurers within the U.S. with a deal with administering Medicare Benefit plans. The agency has constructed a distinct segment specializing in government-sponsored packages, with practically all its medical membership stemming from particular person and group Medicare Benefit, Medicaid, and the army’s Tricare program.

On the finish of 2024, the corporate had roughly 16.6 million members in medical profit plans, in addition to roughly 4.8 million members in specialty merchandise. In 2024, 82% of premiums and providers income got here from contracts with the federal authorities.

On July thirtieth, 2025, Humana launched its second-quarter 2025 outcomes for the interval ending June thirtieth, 2025. For the quarter, the corporate reported revenues of $32.39 billion and adjusted earnings-per-share of $6.27, in comparison with income of $29.54 billion and adjusted earnings-per-share of $6.96 in the identical quarter of 2024.

The Insurance coverage phase reported revenues of $31.09 billion, up from $28.53 billion within the year-ago quarter, pushed by greater Medicare premiums and membership development in state-based contracts and PDPs. The profit ratio for the Insurance coverage phase elevated to 89.9% from 89.5%, reflecting a combination shift towards greater profit ratio companies and incremental investments in outcomes, whereas the working price ratio remained flat at 8.3%.

The CenterWell phase revenues elevated to $5.54 billion from $4.95 billion within the year-ago quarter, attributed to development in pharmacy and first care. The phase’s working price ratio rose to 92.7% from 92.0%, pushed by the phase-in of the v28 danger mannequin revision, partially offset by operational enhancements in major care.

The corporate up to date its 2025 earnings steering. Adjusted EPS is estimated to be roughly $17.00 from $16.25, suggesting a rise of 4.9% from the FY 2024 determine of $16.21. The corporate assumes that its pricing and price methods will help earnings regardless of a decline in Medicare Benefit membership.

Click on right here to obtain our most up-to-date Positive Evaluation report on HUM (preview of web page 1 of three proven beneath):

3. Hershey Co. (HSY)

The Hershey Firm, based in 1894, is a chocolate and sugar confectionary merchandise producer that sells main manufacturers reminiscent of Hershey’s, Reese’s, Kisses, Cadbury, Ice Breakers, Package Kat, Almond Pleasure, Jolly Rancher, Twizzlers, Heath, and Milk Duds. Hershey primarily operates in North America however has worldwide operations as nicely. The corporate is headquartered in Hershey, PA.

On Might 1st, 2025, Hershey reported monetary outcomes for the primary quarter of fiscal 2025. The North America Confectionary phase (82% of gross sales) noticed its gross sales lower -15% over the prior 12 months’s quarter because of abnormally excessive inventories within the second quarter of 2024. Earnings-per-share fell -32%, from $3.07 to $2.09, however beat the analysts’ consensus by $0.16, primarily because of an efficient hedging technique, which partly offset the impact of exceptionally excessive cocoa costs.

Hershey is going through a particularly sturdy headwind from sky-high cocoa costs, which squeeze the revenue margins of the chocolate maker.

Hershey’s earnings-per-share development stems from a number of elements. The primary one is natural income development, which Hershey has achieved regardless of the general public changing into extra aware about wholesome consuming habits. The corporate has additionally been capable of enhance its margins all through the final decade.

Hershey owns well-recognized manufacturers, so value hikes haven’t been a headwind to rising the quantity of its merchandise. Hershey had additionally been reasonably repurchasing its shares, which has added some further development to the corporate’s earnings-per-share.

Click on right here to obtain our most up-to-date Positive Evaluation report on HSY (preview of web page 1 of three proven beneath):

2. Cboe World Markets (CBOE)

Cboe World Markets, Inc. is a big alternate holding firm. It provides a various vary of merchandise in a number of asset courses, and operates in 5 major enterprise segments: Choices, U.S. equities, futures, European equities, and world FX.

Transaction & clearing charges (from contracts or shares traded on exchanges) composed 75% of 2024 revenues, and regulatory charges, market knowledge, and connectivity charges are different income sources.

On August 1st, 2025, Cboe World Markets launched its second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, the corporate reported internet income of $587.3 million, which represents a 14% enhance in contrast with internet income of $513.8 million in the identical quarter final 12 months. Earnings-per-share (EPS) for the quarter have been $2.23, up from $1.33 per share within the earlier 12 months’s quarter. Adjusted EPS was $2.46, up 14% year-over-year.

Second quarter development was pushed by broad-based energy throughout a number of enterprise segments, together with Derivatives (+17%), Money and Spot Markets (+11%), and Information Vantage (+11%), previously Information and Entry Options. Derivatives Markets development mirrored sturdy choices buying and selling volumes (whole choices ADV up 20%). Adjusted working revenue rose to $374.0 million, an 18% enhance year-over-year, and the adjusted working margin was 63.7%, reflecting a rise from 61.4% within the prior 12 months.

Adjusted working bills have been $213.3 million, up from $197.1 million year-over-year, pushed by greater compensation and advantages, depreciation and amortization, and know-how help providers, partially offset by decrease journey and promotional bills {and professional} charges.

Click on right here to obtain our most up-to-date Positive Evaluation report on CBOE (preview of web page 1 of three proven beneath):

1. Greenback Basic Corp. (DG)

Greenback Basic Company opened its first greenback retailer in 1955. Right this moment, it’s the main U.S. “greenback retailer”. About 80% of its gadgets are supplied at $5 or much less. Greenback Basic sells all kinds of merchandise in 4 classes: consumables, seasonal, house merchandise, and attire. About 77% of gross sales are from consumables.

Greenback Basic operated 20,582 shops as of Might 2, 2025. Most shops are situated in cities with 20,000 or fewer individuals and are about 7,400 sq. ft. Whole gross sales have been $40.6B in FY 2024.

Greenback Basic reported Q1 FY2025 outcomes on June third, 2025. After wonderful efficiency throughout and after the COVID-19 pandemic, the corporate is experiencing weak spot. Nonetheless, Greenback Basic remains to be rising albeit extra slowly due to new retailer openings offset by retailer closures. The return of the prior CEO and the Again-to-Fundamentals effort have resulted in renewed focus, optimistic same-store gross sales, and higher working outcomes.

Web gross sales elevated 5.3% to $10,436M from $9,914M on a year-over-year foundation as same-store gross sales grew 2.4% on greater common transactions and retailer openings, offset by retailer closures and decrease site visitors. Diluted earnings per share elevated 7.9% to $1.78 from $1.65 within the prior 12 months on larger income and margins. All 4 classes elevated: consumables (+5.2%), seasonal (+6.2%), house merchandise (+5.9%), and attire (+3.2%).

Greenback Basic raised steering to about 3.7% to 4.7% gross sales development and same-store gross sales development of 1.5% to 2.5%, and diluted EPS of $5.20 to $5.80 in fiscal 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on DG (preview of web page 1 of three proven beneath):

Closing Ideas

Buyers should take danger into consideration when deciding on from potential investments. In spite of everything, if two securities are in any other case related by way of anticipated returns however one provides a a lot decrease Beta, the investor would do nicely to pick out the low Beta safety as they could provide higher risk-adjusted returns.

Utilizing Beta might help buyers decide which securities will produce extra volatility than the broader market and which of them could assist diversify a portfolio, reminiscent of those listed right here.

The 5 shares we’ve checked out not solely provide low Beta scores, however in addition they provide enticing dividend yields. Sifting by way of the immense variety of shares accessible for buy to buyers utilizing standards like these might help buyers discover the very best shares to swimsuit their wants.

At Positive Dividend, we regularly advocate for investing in corporations with a excessive chance of accelerating their dividends each 12 months.

If that technique appeals to you, it could be helpful to flick thru the next databases of dividend development shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.