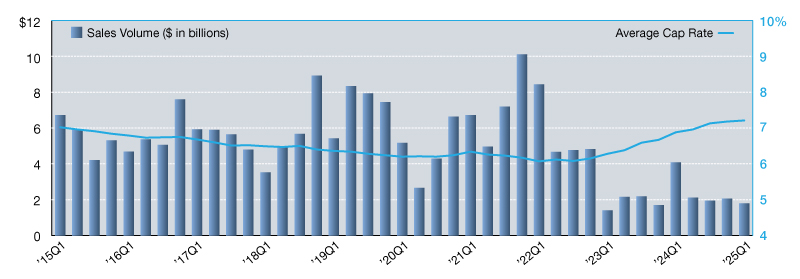

The only-tenant workplace sector continued to grapple with vital challenges in first quarter 2025, as investor warning dampened transaction exercise. Whole gross sales quantity fell to $1.8 billion, marking a 13 % decline from fourth-quarter 2024 and a dramatic 56.2 % lower year-over-year. This ongoing contraction displays persistent headwinds in tenant demand, rising vacancies and sluggish company leasing exercise.

READ ALSO: International Commerce Rebalancing

Cap charges inside the sector edged greater for the tenth consecutive quarter, averaging 7.21 % on the shut of first-quarter 2025. Nonetheless, the tempo of cap price growth has slowed dramatically. When evaluating the 3-basis-point improve reported in the newest quarter to a 30-point rise within the 9 months previous, traits recommend the best volatility is now behind us.

Purchaser distribution information highlighted a shocking shift within the profile of energetic individuals within the single-tenant workplace sector. Institutional traders dominated early 2025 acquisitions, making up 43 % of complete consumers. Predictions in late 2024 known as for this purchaser section to scale back their publicity to workplace area this yr. As a substitute, we’ve seen institutional traders concerned in each massive and small transactions throughout the nation – from small dialysis amenities to company campus sale leasebacks.

Workplace investor sentiment

Non-public consumers, with 31 % of the sector’s market share, displayed robust engagement to begin the yr, whereas REITs have been completely absent, illustrating their heightened uncertainty and restricted long-term confidence within the asset class.

Ongoing tenant downsizing and challenges in backfilling vacant areas weigh closely on investor sentiment. Many workplace properties are struggling to align lease phrases with market calls for, resulting in prolonged intervals of underperformance. To additional complicate issues, billions in loans are set to mature in 2025, placing further strain on present homeowners.

Trying ahead, the online lease workplace sector would require artistic repositioning methods to regain investor curiosity and stabilize leasing fundamentals. Nonetheless, with macroeconomic uncertainties and chronic financing hurdles, near-term exercise is anticipated to stay muted.

—Posted on July 29, 2025