Merchants,

I hope you all had a beautiful lengthy weekend and vacation!

Let’s get proper into a few of my high concepts for the upcoming week:

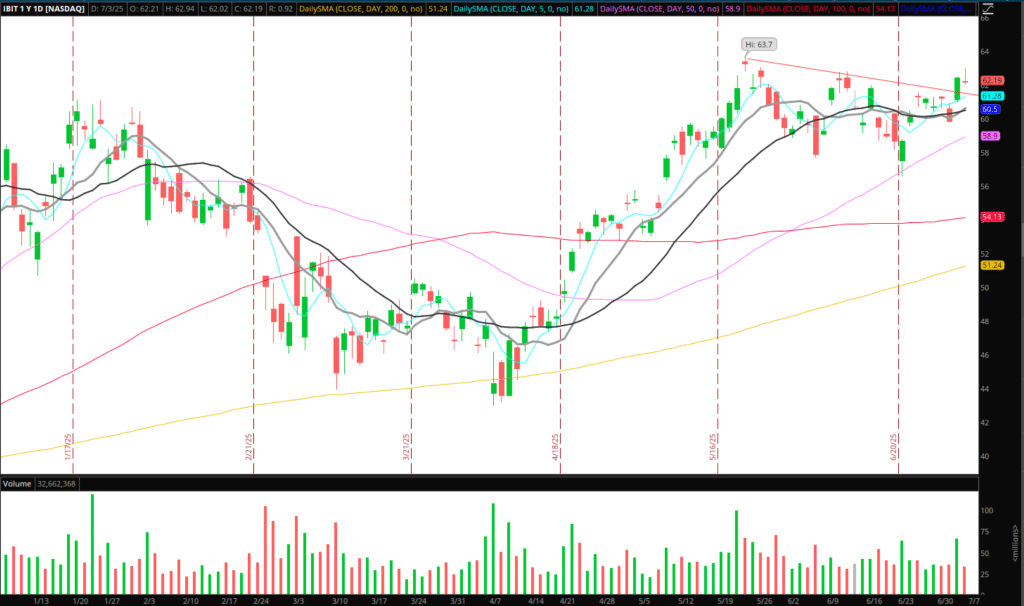

Continuation / Additional Construct in Bitcoin (IBIT)

Beginning with Bitcoin. After the bull flag’s resistance was taken out final week, I might have preferred to have seen higher continuation. Nonetheless, Bitcoin remains to be holding up properly on the time of scripting this. So, going ahead, as I outlined in my earlier IA assembly, I’d wish to see it proceed to construct within the higher portion of its consolidation.

What would assist me acquire confidence and change into aggressive within the swing? If Bitcoin can proceed to carry above the $ 108k space and consolidate. If that motion is adopted by a push above final week’s excessive, close to the 110k space, I’d look to place for the breakout multi-day / week swing.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

If the breakout within the coming days is confirmed, I’d look to carry a core place for a medium-term swing commerce, so long as we don’t break again into the vary or maintain under the day prior to this’s low. As I discussed in my earlier IA assembly, I’m additionally watching Ethereum carefully, and particularly watching a number of of the ETH ETFs as buying and selling autos.

Continuation in Cyber

The cybersecurity business continues to be one of many leaders throughout the expertise sector.. FTNT particularly is wanting promising to me. I particularly like how the identify has consolidated for a number of months in a decent vary above all key transferring averages. Whereas it has lagged behind a number of main names throughout the business, it nonetheless presents a good technical setup.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

So, what’s my plan? If the identify can show some relative energy to the business, and push above final week’s excessive, I’d look to place lengthy for a swing commerce. Particularly, I wish to see it not solely surpass the earlier week’s excessive, however it could additionally want to carry above $106 to show a change of character and breakout. We’ve seen lots of false breakouts out of bases these days, so I might be okay with being a bit later than early and progressively sizing in as soon as it proves appropriate. I’d have a LOD cease on this scenario.

Momentum Lengthy in COIN

A stunning each day chart in COIN, with a major quantity of momentum within the earlier weeks. Final week, COIN had a sustainable pullback towards its 10-day SMA and located assist on Thursday / Friday. For an extended commerce, and doubtlessly multi-day commerce focusing on a transfer towards the $382 excessive, I’d wish to see a better low in opposition to Friday’s motion, and push above Friday’s excessive for entry in opposition to the LOD.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

Right here’s some extra names on look ahead to the upcoming week, together with some commentary surrounding a few common in-play names these days:

I don’t have lots of conviction in particular concepts for the upcoming week. On the whole, I must see a large number of concepts and setups proceed to type, such because the Bitcoin instance. With the market a bit stretched and rotation ensuing, I’m extra inclined to be selective and double down on intraday buying and selling while swing concepts proceed to type.

Momentum in Quantum: QUBT, QBTS, IONQ, and RGTI have all held up exceptionally properly and ticked increased over the previous few days. Monitoring the sector for potential intraday momentum within the coming days, in the event that they proceed to construct and close to breakout ranges.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

Basic Ideas on TSLA: I’ve bought lots of questions on Tesla in current IA conferences. From an intraday perspective, it stays an ideal buying and selling automobile round key ranges. However from an extended swing buying and selling perspective, I’ve little interest in a place in Tesla till it could reclaim its 10 and 20-day SMA and base for a couple of days. Momentum in the meanwhile is gone, and it’s 50.50 proper now. So, till it reclaims its 10 and 20-day SMA, I received’t be searching for an extended swing there.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

Consolidation Breakout in INOD: Nothing that I’m trying to take motion on instantly. Nonetheless, with a gentle multi-month advance and small and mid-caps just lately breaking out, I’ve alerts set for a potential breakout above $ 52 for continuation within the coming days to weeks.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures